The Debt Dilemma: No Real Estate Sector is Immune

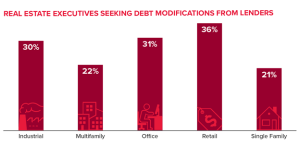

While each real estate sector’s performance and challenges were very much unique during the COVID years, they have now unified on at least one front: debt modifications. According to BDO’s Survey of Real Estate Executives, each sector will be looking to modify their debt instruments in the coming year. With $2.7 trillion of debt expected to mature by 2027, coupled with higher interest rates, it is no surprise we are seeing more than one-quarter of real estate companies seeking to modify their debt agreements. But the debt modification path is not without its challenges.

The Rise of Debt Modifications For Real Estate

The hurdles facing real estate owners seeking debt modification are robust; so robust that some are turning to the ways of 2008 and handing their keys back to lenders. Lenders have recently changed loan-to-value ratios, compounding the dilemma for owners. While a 70% loan-to-value ratio in most sectors has been the standard for years, property owners are now experiencing loan-to-value ratios in the 55% range, putting more pressure on owners to find other capital sources to sure up their equity position with lenders. Private equity is a major source of capital that is currently filling the void.

Looking Ahead

Debt modifications could offer an avenue for both lenders and borrowers to weather economic volatility and build more suitable debt agreements for the long term.